Sorry, nothing in cart.

Ally Mortgage Lender Remark 2022: Effortless Electronic Procedure, However, Minimal Financial Options

- By hasan özdemir

- |

- bad credit no credit check payday loans

- |

- 0 Comment

Ally Domestic could be a good idea if you’re looking getting a fundamental mortgage and you will favor a totally electronic application techniques. You can score a great pre-approval page on the internet or from app in minutes, which can help you stop-initiate your house-looking processes.

It is very important highlight, no matter if, the business’s criticism background. With regards to the Individual Economic Protection Bureau problem database, Ally Economic got highest-than-average consumer issues opposed almost every other lenders we have reviewed.

Editorial Liberty

Just like any in our lending company feedback, all of our studies isnt determined by one partnerships otherwise ads matchmaking. For more information on the scoring strategy, follow this link.

Ally Home loan Complete Review

Ally Domestic, the loan department out-of Friend Economic, are an on-line financial which have a smooth digital home loan process. Borrowers will get home financing pre-recognition, publish files, tune this new progress out-of a software, and digitally signal disclosures – all of the on the internet otherwise by way of a straightforward-to-use mobile application.

And because it’s the full-solution on the internet financial, Ally now offers examining and you may savings account, automobile financing, paying points, signature loans, plus. Having current banking consumers, bringing a mortgage having Friend has the extra advantage of remaining all of your current profile with one financial.

This new downside: Ally’s mortgage menu and you will impact is actually limited today and you can the company received an increase buyers complaints from inside the 2020. Borrowers when you look at the 37 says plus the District of Columbia can use having a traditional, jumbo, otherwise refinance loan, but if you are looking for a government-supported loan like an enthusiastic FHA otherwise USDA mortgage, you will be regarding luck.

Ally Home mortgage: Loan Brands and you can Circumstances

Ally cannot bring U.S. Institution off Farming mortgages (USDA fund), Government Housing Management mortgages (FHA loans), Agencies away from Veterans Items mortgage loans (Virtual assistant finance), reverse mortgage loans, home improvements loans, or other market affairs.

Ally also provides jumbo loans that may stretch doing $4 billion. Advance payment conditions will vary with regards to the matter you happen to be borrowing.

Whenever you have got a preexisting home loan, you might exchange it with an increase-and-term re-finance – probably helping you save currency – otherwise tap your property security using a money-aside refinance.

Having Ally, you’ll have an option anywhere between a fixed-rate loan, where price never change, and you can a varying-rate home loan (ARM), the spot where the rates get changes occasionally. You might choose a fixed-rate label out-of 31, 20, otherwise 15 years and Arm terms of ten/1, 7/1, and 5/1. That have an effective 5/step one Case, such as for example, you’d have the same interest rate towards the first five years. Next, the pace might have to go upwards or down one time per year to own the remaining title, according to greater home loan market.

Ally Home loan Transparency

Friend Residence’s webpages is simple in order to browse and you can demonstrably lies away the brand new homebuying process. https://cashadvancecompass.com/loans/faxless-payday-loans/ In addition it includes several hand calculators and you may books to help you select the right financial for your situation and figure out how far domestic you can afford.

Customers may a personalized price estimate on the web within a few minutes and you can actually get financing pre-recognition. If the individuals keeps issues otherwise need help, loan officers arrive by the telephone call. Friend cannot take care of within the-people twigs once the more lenders would, thus talking face-to-deal with is not a choice.

It is important to point out the company’s problem record, but not. With regards to the Consumer Financial Defense Agency complaint databases, Ally Monetary got large-than-mediocre consumer problems inside ratio so you’re able to its overall loans originated 2020. This was somewhat highest compared to the almost every other lenders we’ve assessed. The most popular complaints cited were throughout the:

- Mortgage loan modification, range, and you can foreclosure procedure

- Financing maintenance, money, or escrow membership

- Problems throughout the fee process

Ally Home mortgage: Prices and you can Fees

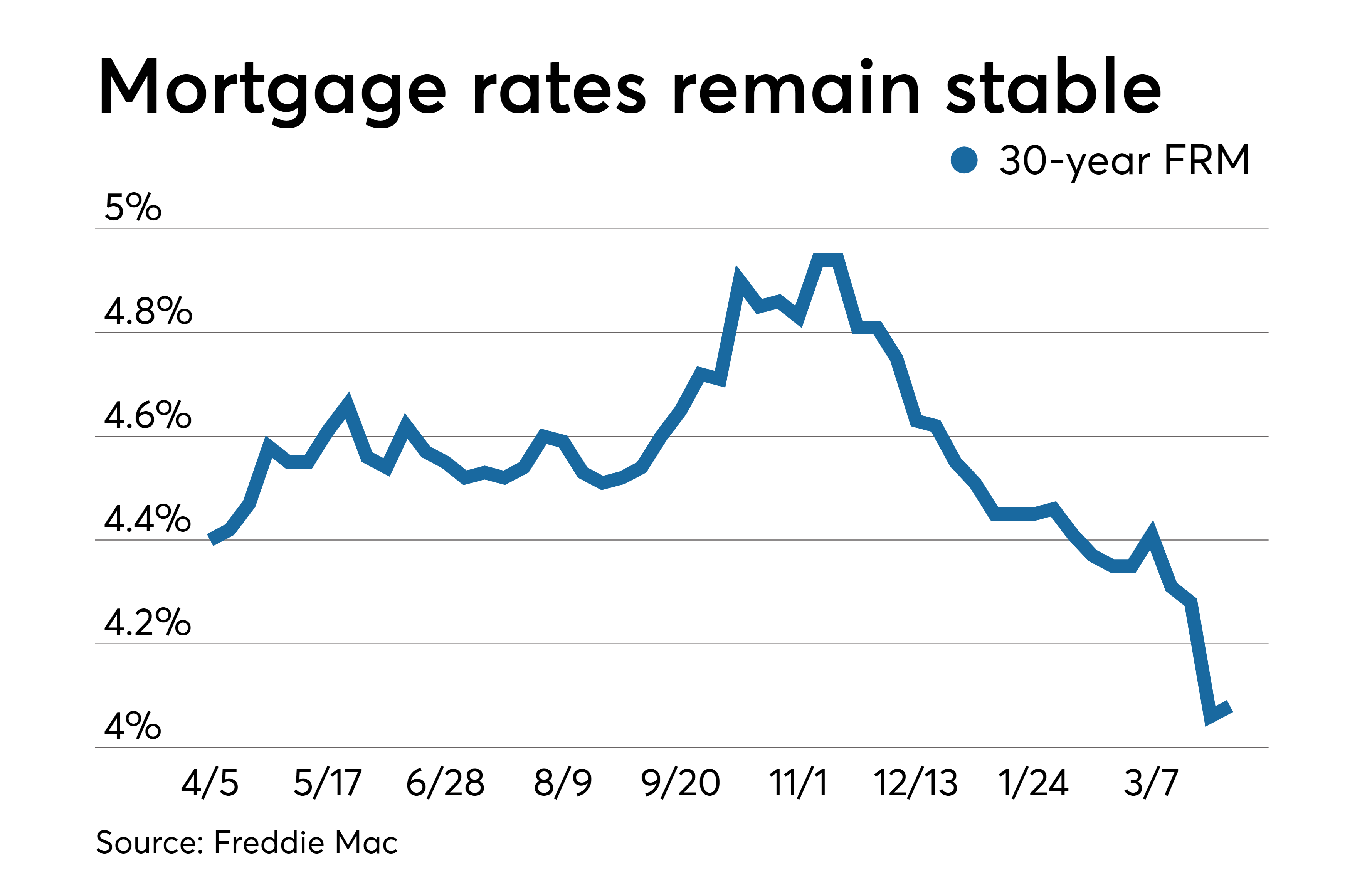

Friend Family advertises purchase and you can refinance pricing to have 15-, 20-, and you can 31-season mortgages also a number of Sleeve conditions. The financial institution plus certainly demonstrates to you what kind of cash you might pay money for dismiss situations, that’s an elective payment you can pay to lessen your price.

To help you be eligible for home financing, you will need a credit history of at least 620 to possess conforming funds and you can 700 for jumbo financing. But not, a high score will most likely help you to get top home loan cost.

Because industry average to possess closure towards a mortgage try 58 weeks, Friend Home’s average is just about 38 months this season on purchase finance, according to an ally spokesperson. This can cause you to the latest closing desk quicker, which can sweeten the deal if you are setting up a buy render.

You could potentially protected mortgage online for approximately 75 weeks free of charge and you may probably expand the interest rate secure. Consumers never ever shell out financial fees otherwise prepayment punishment.

Bir yanıt yazın